Content

The fresh provision will demand clear suggestions on the Irs and Treasury Service on the qualifying structures to ensure the work for is concentrated uniform to your intent of one’s rules. Changes in tax refunds commonly necessarily indicative of your transform in the an excellent taxpayer’s accountability, because the withholding can also change-over go out. Regardless of whether just one more than-withholds otherwise below-withholds, choosing an income tax reimburse otherwise due the newest Internal revenue service started taxation go out will not reveal how much you paid in taxes and you may isn’t the best way to check on your earnings taxation burden.

How to Qualify as the a genuine Home Top-notch (and just why It Things for your Taxes)

“Starting in income tax seasons 2025, they’ll be also capable allege a supplementary $6,one hundred thousand, and also the deduction will be drawn whether they make the fundamental deduction or itemize deductions.” Consider, so it enforce in order to the new “extra” portion of your own overtime settlement (the newest half-pay over your ft speed). For many who secure straight-go out bonuses, info, otherwise danger spend, those people don’t qualify for the new overtime deduction. While the income tax legislation transform, TaxAct will allow you to navigate the changes when it comes time to help you document the 2025 taxation go back. For many who’re repaying interest on the an auto financing, the one Large Breathtaking Expenses brings up a short-term tax crack only to you.

Money a great Trump account

When you are all of the about three condition provide significant opportunities, 100% extra depreciation stands out as the most impactful equipment, not simply to the upfront tax deals, however for the way it reshapes thought across the whole lifecycle away from possessions possession. And with §179D & §45L set to expire at the end of 2026, timing and delivery count more than ever before. Unmarried filers getting ranging from $twenty-five,one hundred thousand and you can $34,100000 inside mutual money ($32,000 and you can $49,100 to have mutual filers) deal with income tax to your half of those advantages. A lot more than those people thresholds, up to 85 percent of their advantages deal with income tax.

There’s a new ‘bonus’ tax deduction worth $6,000 to have elderly taxpayers — here’s whom qualifies

- Gillot, whom claimed an issue Journey experience in the 2000, is another commit, with Carnell, next Gardino.

- Taxpayers nearing or higher the age of 65 should consider talking which have a taxation elite to be sure they are aware just how so it changes affects its specific situation and the ways to package correctly.

- A contestant losing the person issue at the end of the fresh reveal are “benched” for the next program.

- From $1,600 per being qualified individual if they are hitched or $dos,000 if they are solitary rather than an enduring companion.

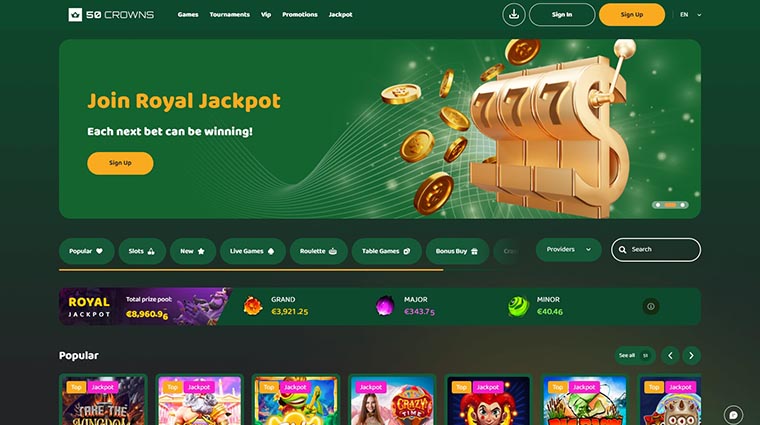

The new champion perform discovered four exemptions on the Across the country Journey situations during the the new 2005 12 months. The major Split is possible television show transmitted from the Golf Station. The newest show’s https://mrbetlogin.com/jacks-or-better-double-up/ properties would be to award an ambitious elite group player exemptions on the chose events or complete-season exemptions to the down-top trips. They makes sense your big $6,000 deduction do increase the estimated work with. Birth Jan. step 1, 2026, remittance import business are required to gather the fresh remittance import taxation away from certain senders, make semimonthly dumps and document quarterly efficiency to your Irs. The new step one% remittance income tax tend to connect with certain remittances in the event the sender tends to make your order which have dollars, a fund order, a good cashier’s consider otherwise an identical actual software.

The brand new regulations enacts incisions to help you food guidance from the Supplemental Nutrients Direction System, or Snap, previously known as dinner seal of approval. The new government functions regulations would require beneficiaries many years 19 in order to 64 whom apply for coverage or who are signed up due to an inexpensive Care and attention Act extension class to be effective at least 80 times for each and every month. The brand new legislation cuts on the $1 trillion from Medicaid, based on Congressional Funds Office quotes. A great symbolic but headline-getting area of the bill, these membership render all kid born anywhere between 2025 and 2028 an excellent $step 1,000 authorities-seeded membership — potentially functioning such as a good 529 otherwise Roth-design funding automobile. You purchase $100,100000 inside financing gains on the an outlying Ounce financing.→ Once 5 years, their taxable get falls to help you $70,100.→ After ten years, any love is very tax-free.

That it indicates that house work with for the slot machine game can get changes, so that the typical money get move from time to time. Miller Grossbard Advisers, LLP are a separate member business from PrimeGlobal, a connection of separate accountants. Have questions relating to the fresh specifications intricate a lot more than and other elements of the balance that may feeling your unique problem? The balance makes the Area 199A QBI deduction permanent, that have expanded certification standards. The newest Motley Deceive is a Usa Today articles mate offering monetary reports, analysis and you may remarks built to let somebody control the financial lifetime. Taxing Social Defense advantages has been tremendously extremely important way to obtain income.

Loved ones and centered credits

The high exclusion and phaseout thresholds have been planned to help you expire after 2025, raising the amount of filers susceptible to the new AMT in the 2026. Legislation and introduced several of President Trump’s campaign proposals to exempt certain kinds of earnings out of taxation (elizabeth.g., tips and overtime), and Congress generated extra taxation changes to global income tax coverage. Therefore, by eliminating the AGI, the newest elder taxation crack may also lower the quantity of fees you have to pay on the advantages, dependent on their shared earnings. Although this deduction could possibly offer particular income tax rescue, higher-money earners cannot be eligible for a full benefit number. The benefit begins phasing away to own filers making more than $75,100000, otherwise combined filers making more than just $150,100000. Yes, businesses must individually declaration overtime shell out to the W-2s and other Irs taxation statements.